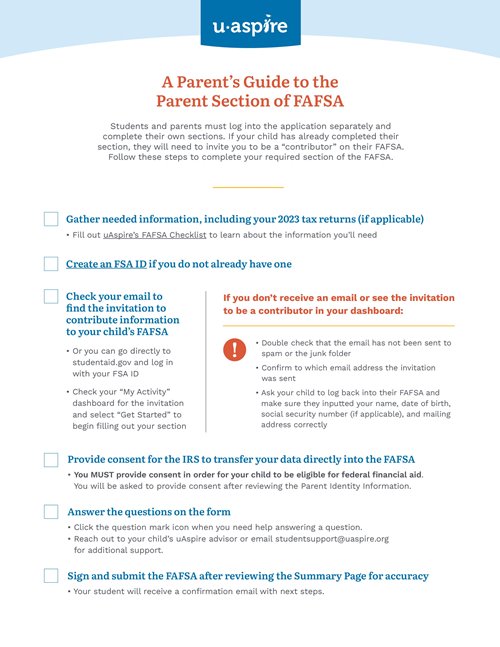

A Parent’s Guide to the Parent Section of FAFSA

A Parent’s Guide to the Parent Section of FAFSA

Take the Stress Out of FAFSA with This Step-by-Step Guide

Take the guesswork out of completing the FAFSA Parent Section

Navigating the FAFSA can be overwhelming, especially for parents.

That's why we created A Parent’s Guide to the Parent Section of FAFSA, a clear, step-by-step resource to help you complete your portion of your child's application confidently and accurately

*Also available in Arabic, Cape Verdean, Haitian Creole, Portuguese, Simplified Chinese, Spanish, Traditional Chinese, and Vietnamese.

What You’ll Learn:

How to Start:

Guidance on accessing your child’s FAFSA and becoming a “contributor.”

What You’ll Need:

A checklist of essential documents, including your previous year’s tax returns.

Step-by-Step Instructions:

Learn how to:

Provide IRS consent to transfer your tax data.

Answer questions with ease using in-app tips and tools.

Review and sign the FAFSA to ensure eligibility for federal financial aid.

What to Do if You Run Into Issues:

Troubleshooting tips for missing invitations or incorrect information.

Download the Guide Now!

Click the button below to receive your free copy of A Parent’s Guide to the Parent Section of FAFSA.

FAQs

How do I access the parent section of FAFSA?

Go to fafsa.gov to be taken to the FAFSA home page, and then select “Start New Form.” You'll be directed to log in to your StudentAid.gov account. Once you're logged in, you'll be taken to the next page, where you will see two options. If you're starting the FAFSA form on behalf of your child, choose “Parent.”

How much money do parents have to make to qualify for FAFSA?

There is no set income limit for eligibility to qualify for financial aid. The FAFSA needs to be filled out every year to see what you qualify for at your college. It's important to make sure you fill out the FAFSA as quickly as possible once it opens for the following school year.

Which parent should be used for FAFSA?

If the parents are divorced, separated, or never married; don't live together; and provided an exact equal amount of financial support or if they don't support the student financially, the parent with the greater income and assets is the contributor.

Are parents financially responsible for FAFSA loans?

Parents are not obligated to repay their child's federal student loans, even though their information is required for the Free Application for Federal Student Aid (FAFSA). Parents may be held responsible for student loan debt if they co-signed a private loan or took out a parent PLUS loan.

Resources for FAFSA Success

Learn More About FAFSA and Financial Aid

Check out our other resources to help you understand and navigate financial aid

5 Tips to Complete the 25-26 FAFSA

Blogs

uAspire’s Guide to Finding and Applying to Scholarships

Blogs

-(small).png)

Five Tips for Completing the CSS Profile

Blogs

Ready to take control of the FAFSA process?

Help your child secure the financial aid they need to achieve their educational goals.